CERSAI Portal – An essential component of the Indian financial system is the Central Registry of Securitization Asset Reconstruction and Security Interests of India. Maintaining and managing security interests is of paramount significance, especially when it comes to loans, mortgages and securitization transactions. An online platform called CERSAI makes it possible to register and track transactions involving security interests in both moveable and immovable properties. In this article you get every necessary information regarding this portal such as benefits, objectives, eligibility criteria, necessary documents, overview, registration and login process.

Table of Contents

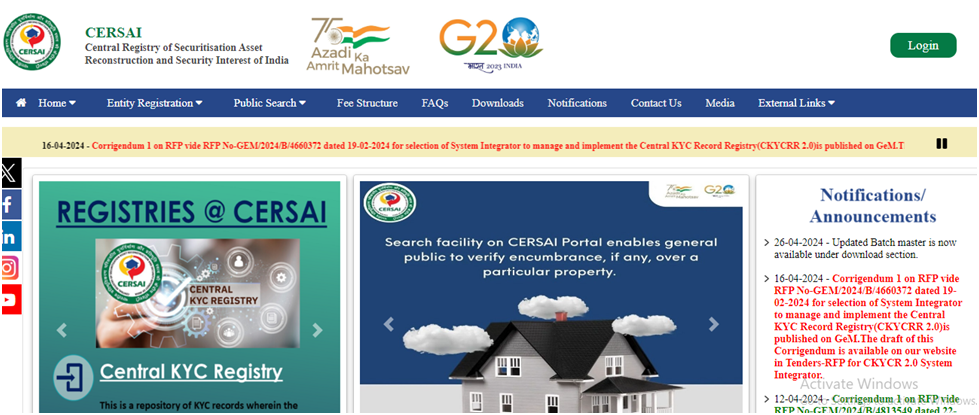

CERSAI Portal 2024

The central government introduced the CERSAI portal in an effort to stop mortgage fraud. This allows for the investigation of the fraudster’s method of getting many loans on the same plot of property from various institutions.

The majority of CERSAI’s shares are owned by the national government, public sector banks (PSBs) and the National Housing Bank in addition to the domestic base that this portal also serves. Furthermore, the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002 provides coverage for CERSAI registration.

Overview Of CERSAI Portal 2024

Objective Of CERSAI Portal

The main objective of the portal is to serve as a registration mechanism for the management and upkeep of a KYC Registry. In addition, it is regulated by the PML Regulations of 2005 and the Central KYC Records Registry houses more than 35 crore KYC records. The Online Security Interest Register for India contains all important data on loans, making it simple for lenders and borrowers to obtain it. Any interest that banks earn on securities must also be disclosed to the government, the CERSAI site is where this information may be submitted.

Benefits Of CERSAI Portal

Some of the benefits of the portal is given below:

- You can obtain specific details on the available property.

- The primary goal of this site is to stop any fraudulent activities that are currently taking place in the construction sector, making it simple for an innocent person to apply for a loan from a bank.

- This portal was made in order to identify those who are engaging in fraud.

- Court orders and attachment orders for encumbered or attached properties are also available through the portal.

- The system identifies fraudulent conduct connected to fair mortgages by providing data transparency.

Eligibility Criteria

Some of the eligibility criteria of the portal is given below:

- The applicant must live in India.

Required Documents

Some of the required documents of the portal is given below:

- Aadhaar Card

- Identity Card

- Email ID

- Mobile Number

Registration Procedure Of CERSAI Portal

- First you have to visit the Official Website of the portal.

- The homepage will appear on your screen.

- Click on the SignUp or Register option.

- Enter all the required details such as:

- Name

- Contact Number

- Organizational Detail

- After completing the sign-up procedure, confirm your mobile number or email address.

Login Procedure

- First you have to visit the Official Website of the portal.

- The homepage will appear on your screen.

- Click on the Login or Sign In option.

- Enter your registered account and password.

- You may now use the many services and activities offered by CERSAI after logging in.

FAQ’s

Who owns the CERSAI?

Several of the biggest banks and financial institutions in India own CERSAI. It is a publicly traded business run by a board of directors composed of representatives from the institutions that make up its membership.

What is the maximum extent of the threshold?

The smallest amount of usable balance that can be charged on the website is known as the threshold limit.

Who pays the CERSAI fees?

CERSAI fees are incurred by people or companies that take part in various financial operations including the assignment of receivables, the creation or modification of security interests and the securitization or reconstruction of financial assets.

What is the Official Website of the portal?

https://www.cersai.org.in/CERSAI/home.prg