The Rythu Bima Scheme, initiated by the Telangana state government, is a significant financial assistance program aimed at providing social security to farmers and their families. Launched on August 15, 2018, this scheme is also known as the Farmers Group Life Insurance Scheme. It seeks to mitigate the financial burdens that families face due to the untimely death or permanent disability of a farmer.

Objective of the Rythu Bima Scheme

The Rythu Bima Scheme primarily aims to provide financial security for farmers and their families in Telangana. The purpose is to ensure that in the event of a farmer’s untimely demise, the family does not face immediate financial hardships.

- Financial Assistance: The scheme offers a substantial insurance coverage amount of ₹5 lakh to the registered farmer’s nominee. This financial aid is crucial for families who rely on farming as their primary source of income.

- Social Security: By providing life insurance, the scheme aims to offer social security to farmers’ families. It ensures that they have a financial safety net during crises such as accidents or natural calamities leading to death.

- Reduced Financial Burden: The government subsidizes 75% of the premium, making it affordable for farmers to participate in the scheme. This subsidy alleviates the financial strain on farmers who otherwise may struggle with premium payments.

Read Also – Rythu Runa Mafi Status

Key Highlights of Scheme

| Eligibility Criteria | Age: 18-59 years- Residency: Telangana- Ownership of agricultural land or proof for tenant farmers |

| Insurance Coverage Amount | ₹5 lakh (approximately $6,928) |

| Premium Subsidy | – Total annual premium: ₹1,200- Government subsidy: ₹900 (75%)- Farmer’s contribution: ₹300 (25%) |

| Application Process | Online through the official portal |

| Required Documents | – Aadhaar card- Bank passbook (first page)- Land ownership documents- Proof of residence |

| Claim Settlement Period | Within ten days after verification by Life Insurance Corporation (LIC) |

Eligibility Criteria

Age Requirements:

- Farmers must be aged between 18 to 59 years to qualify for the scheme.

Residency:

- Applicants must be residents of Telangana. This ensures that the benefits are directed towards local farmers who contribute to the state’s agricultural sector.

Land Ownership:

- Ownership of agricultural land is a key criterion. Farmers should possess a Pattadar Passbook, which serves as the land ownership document.

- Tenant farmers can also apply if they provide proof of cultivation and share premium payment details with landowners.

Read Also – Rythu Runa Mafi 2nd List

Number of Beneficiaries

The Rythu Bima Scheme has significantly impacted the lives of farmers in Telangana since its inception. According to estimates, over 57 lakh farmers have benefited from this scheme. This extensive coverage underscores the government’s commitment to providing financial security and social support to the agricultural community.

Impact on Farming Communities

- Financial Relief: The insurance payout of ₹5 lakh offers substantial financial relief to families following the unfortunate demise of a farmer, helping them manage immediate expenses and stabilize their economic situation.

- Social Security: By ensuring that every registered farmer is covered, the scheme bolsters social security within farming communities, reducing uncertainty and stress among farmers regarding their family’s future.

- Inclusivity: Tenant farmers are also included under this scheme, provided they present valid proof of cultivation and shared premium payment with landowners. This inclusivity ensures that even those without land ownership documents can avail themselves of the benefits.

Required Documents

- Aadhaar Card

- Pattadar Passbook

- Bank Passbook (First Page)

- Proof of Residence

- Death Certificate (For Claims)

- Application Form

Benefits

The Rythu Bima Scheme offers numerous advantages designed to support and secure the families of farmers in Telangana. Key benefits include:

₹5 Lakh Insurance Coverage

- Financial Assistance Amount: Upon the sudden demise of a registered farmer, the nominee is entitled to receive a financial assistance amount of ₹5 lakh. This substantial sum helps mitigate the economic impact on the farmer’s family, ensuring they have necessary funds during difficult times.

- Timely Payouts: The insurance payout process is streamlined to ensure that claims are settled within ten days by the Life Insurance Corporation (LIC) after verification. This efficiency ensures that families do not face prolonged financial distress.

Read Also – Crop Loan Waiver Scheme Telangana

Subsidized Premiums

- Affordable Premiums: Farmers only need to pay an annual premium of ₹1,200, out of which ₹900 is subsidized by the government. This significant subsidy makes it easier for farmers to afford life insurance coverage.

- Government Support: The Telangana government’s contribution covers 75% of the total premium amount, highlighting their commitment to supporting the agricultural community.

Social Security

- Economic Stability: By providing a safety net, this scheme ensures that bereaved families have immediate access to funds, reducing their financial burdens during crises.

- Encouragement for Farming: With social security measures like Rythu Bima in place, there is a positive impact on farming communities as farmers feel more secure about their future and that of their families.

These benefits underscore the importance and effectiveness of the Rythu Bima Scheme in enhancing the welfare and security of farmers’ families across Telangana.

How to Download the Application Form PDF

- Visit the official Telangana State Government’s Rythu Bima portal.

- Locate the “Rythu Bima Scheme” or “Farmers Group Life Insurance Scheme” section.

- Click on the “Download Application Form” link to open the PDF.

- Save or print the form for submission.

- Fill out all required fields accurately in the form.

- Submit the form online or at designated agricultural offices.

Rythu Bima Scheme Login 2024

- Open your web browser and go to the official website of Rythu Bima Scheme.

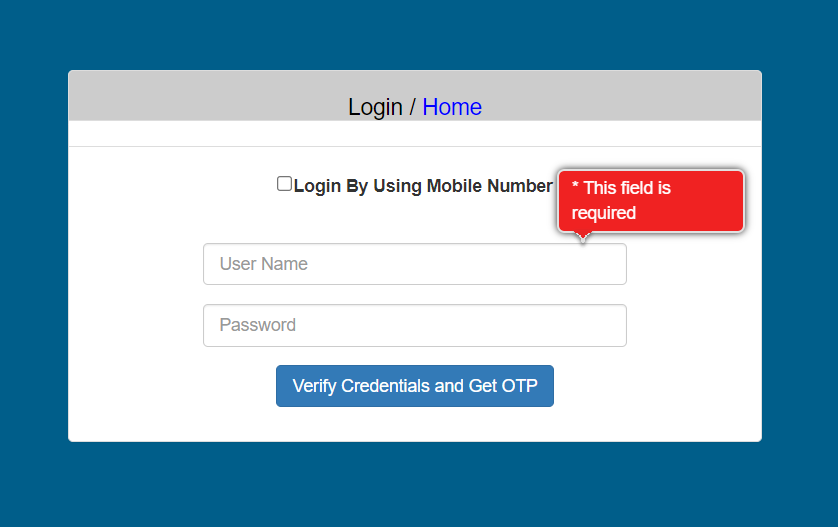

- On the homepage, find and click on the “Login” button.

- Input your registered User ID and Password in the respective fields.

- Complete any captcha verification or additional security steps as prompted.

- Once logged in, you will be directed to your dashboard where you can check application status, update personal information, view policy details and premium payment status, access claim forms.

- Always remember to log out after accessing your information to ensure your data remains secure.

FAQs

1. Who is eligible to apply for the Rythu Bima Scheme?

To be eligible for the Rythu Bima Scheme, applicants must be aged between 18 and 60 years, reside in Telangana, and hold a Pattadar Passbook (land ownership document) or provide proof of cultivation if a tenant farmer.

2. What benefits does the scheme offer?

The scheme provides ₹5 lakh insurance coverage to the nominee in case of the registered farmer’s death. The government subsidizes 75% of the annual premium, making it highly affordable for farmers. Farmers pay only ₹300 annually, with ₹900 funded by the government.

3. How can farmers apply for the scheme?

Farmers can apply online through the official portal. Required documents include Aadhaar card, bank passbook (first page), land ownership documents, and proof of residence.

4. What is the claims process under this scheme?

To make a claim, submit relevant documents like death certificates and bank details to the insurance company within six months of the farmer’s death. Claims are verified and settled by LIC within ten days.

5. Can tenant farmers benefit from this scheme?

Yes, tenant farmers are eligible if they provide proof of cultivation and share premium payments with landowners.

6. What documents are necessary for claim submission?

To submit a claim, you need Aadhaar card, Pattadar Passbook, death certificate, and bank details of the nominee.

7. How long does it take for claims to be settled?

Claims are generally settled within ten days after verification by LIC.

8. Where can I check my application status?

You can log into the official Rythu Bima Scheme portal using your credentials to check your application status and get updates.