New EPFO Rules – The Employees Provident Fund Organization (EPFO) made several substantial changes Starting on 1 April. When a person changes jobs, the new rule will instantly transfer their prior Provident Fund (PF) balance to their new employer. Consequently, when an EPFO account holder joins a new workplace, they are no longer needed to separately request PF transfers. Even if someone had a Universal Account Number (UAN), they wouldn’t need to go through the hassle of requesting PF transfers. In this post you get every necessary information regarding this scheme such as benefits, objectives, eligibility criteria, required documents, check procedure of UAN.

New EPFO Rules 2024

The Employees Provident Fund Organization (EPFO) was founded by the Central Government according to the authority granted by section 6A of the Employees Provident Fund and Miscellaneous Provisions (EPF and MP) Act, 1952. On 15 November 1951, the Employees Provident Funds Ordinance was declared, officially establishing the Employees’ Provident Fund. In order to facilitate Provident Fund number portability, the Indian government introduced the Universal Account Number (UAN) for employees on 1 October 2014 which is covered by EPFO.

On 1 April a new regulation pertaining to the transfer of Provident Funds upon employment change went into force. Workers will no longer need to manually submit requests to receive provident funds when they change employment. When a person changes employment, EPFO has put in place a system that automatically transfers their Provident Fund (PF) amount.

Overview of New EPFO Rules 2024

Objective of New EPFO Rules

The main goal of the new EPFO regulations is to make the transfer of employees PF balances to their new employers seamless by having EPFO credit them instantly. The government wants to do away with the need for holders of EPFO accounts to manually request PF transfers when they join a new company. The New EPFO Rules provide that workers PF balances will be immediately transferred to their new employer’s PF account if their Universal Account Number (UAN) is linked and fully complies with Know Your Customer (KYC) standards.

Benefits of New EPFO Rules

The benefits of this scheme is given below:

- The system that transfers an employee’s provident fund (PF) balance automatically when they change employment is managed by the Employees Provident Fund Organization (EPFO).

- Employees will have a smooth transfer thanks to EPFO’s automated crediting of the PF balance to the new employer’s account.

- In accordance with the New EPFO criteria, a member does not need to make a transfer claim upon changing jobs if the employee’s Universal Account Number (UAN) is seeded and completely KYC-compliant.

- According to the new EPFO Rules, an auto trigger for transfer will be established anytime an employee starts a new job and their first month’s income is transferred to their PF account.

Eligibility Criteria

The eligibility criteria of this scheme is given below:

- The applicant must live in India.

- According to the New EPFO Regulations, employees in the public or private sectors may be qualified to receive benefits.

- Employees must be at least 18 years of age.

Required Documents

The eligibility criteria of this scheme is given below:

- UAN Number

- Aadhaar Card

- PAN Card

- Salary Slip

- Email ID

- Mobile Number

Procedure to Check Universal Account Number (UAN)

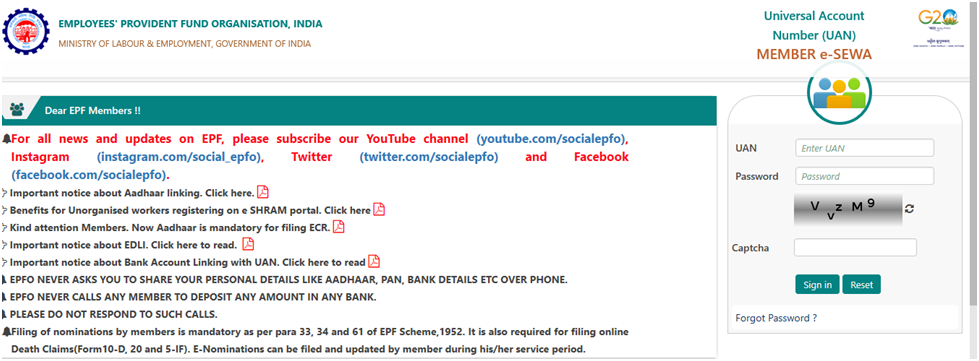

- First you have to visit the Official Website of the scheme.

- The homepage will appear on your screen.

- Click on the Know your UAN option.

- Enter your mobile number and captcha code.

- Click on the Request OTP button.

- A new page will appear on your screen.

- Enter your Name, Date of Birth, select any one option from Aadhaar, PAN or Member ID.

- Enter information about the alternatives you have chosen.

- You have to enter the captcha code.

- Click on the Show My UAN.

- Your UAN will appear on your screen.

FAQ’s

Who launched the New EPFO Rules?

The Employees Provident Fund Organization (EPFO) was founded by the Central Government according to the authority granted by section 6A of the Employees Provident Fund and Miscellaneous Provisions (EPF and MP) Act, 1952.

Which of the New EPFO Rules is the main benefit?

The procedure that transfers an employee’s provident fund (PF) balance automatically when they change employment is managed by the Employees Provident Fund Organization (EPFO).

Who is eligible for the New EPFO Rules?

According to the New EPFO Regulations, employees in the public or private sectors may be qualified to receive benefits.