The Uttarakhand government has introduced the IGRS Uttarakhand platform to simplify processes relating to property and marriage registration. People’s property records have been maintained online on this platform in order to safeguard their assets. On this government created platform, it is simple to register properties, register marriages, pay stamp duty and pay registration fees. In this article you get every necessary information regarding this portal such as benefits, eligibility criteria, necessary documents, charges, services and registration process.

IGRS Uttarakhand 2024

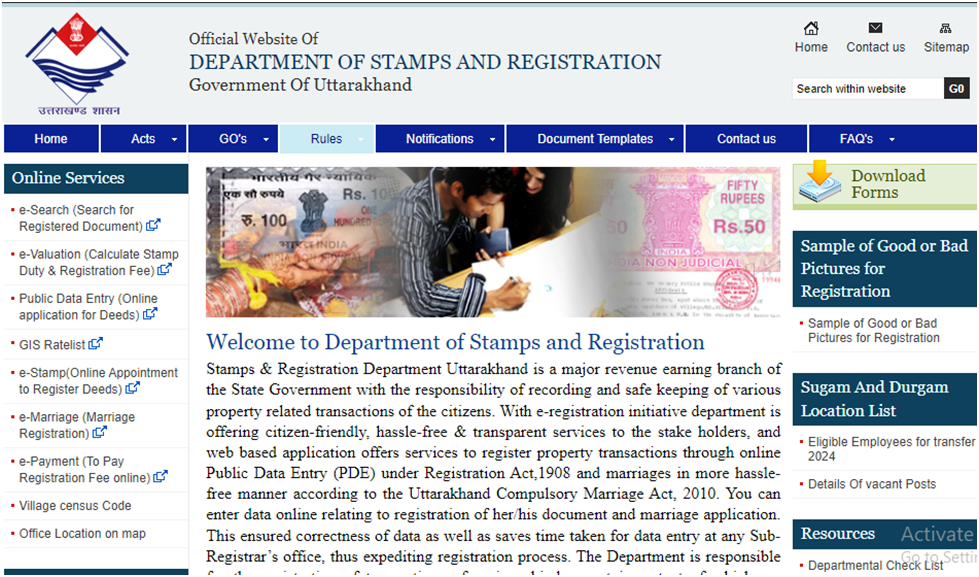

The state organization in charge of enforcing and collecting various taxes pertaining to property and other things is called the Inspector-General of Revenue and Stamps or IGRS. In order to facilitate services and ensure transparency, a house buyer in Uttarakhand may register and pay the stamp duty online using the online Public Data Entry (PDE) option under the Registration Act of 1908.

Furthermore, the Stamp and Registration Department of Uttarakhand offers the opportunity for individuals to register their marriage online in accordance with the Uttarakhand Compulsory Marriage Act of 2010. Visit the IGRS Uttarakhand website in order to make use of these services.

Overview Of IGRS Uttarakhand 2024

Objective Of IGRS Uttarakhand

This portal’s primary goal is to facilitate property transactions and offer a range of online services. This portal offers an infinite number of other services including online registration for property registration, marriage registration, stamp duty payment and registration fees.

Benefits Of IGRS Uttarakhand

Some of the benefits of this portal is given below:

- The portal was developed by the Uttarakhand government to facilitate property related transactions and offer a range of online services.

- When purchasing or selling real estate in Uttarakhand, the buyer is required to pay the Uttarakhand government a specific sum in stamp duty and registration fees.

- In Uttarakhand, a house buyer has the option to pay the stamp duty and registration cost online.

- Stamp duty and registration fees in Uttarakhand have a deadline for payment. Government regulations require that fines be paid in the event that stamp duty and registration fees are not paid within the specified time frame.

Eligibility Criteria

Some of the eligibility criteria of this portal is given below:

- The applicant must live in Uttarakhand state.

Required Documents

Some of the required documents of this portal is given below:

- Aadhar Card

- Property Documents

- Address Proof

- Email ID

- Mobile Number

IGRS Uttarakhand Stamp Duty And Registration Charges 2024

| Applicants | Stamp Duty Charges | Registration Charges |

| Female Applicant | 3.75% | 2% |

| Male Applicant | 5% | 2% |

| Joint (Male + Female) Applicant | 4.37% | 2% |

| Joint (Female + Female) Applicant | 3.75% | 2% |

| Joint (Male + Male) Applicant | 5% | 2% |

Uttarakhand Stamp Duty Charges For Various Deeds

| Category | Registration Fee | Stamp Duty |

| Power of Attorney (PoA) Registration | Rs.100 | Rs.50 |

| Immovable Property as Gift (Gift Deed) Registration | 2% of the market value of the property | 5% if the value of the concerned property, 1 percent for family member |

| Sale Certificate Registration | 2% of the consideration amount | 5% of the sale consideration |

| Agreement Registration | 2% on advance money | Rs.1000 |

| Will Registration | 2% of the consideration amount | No Stamp Duty Required |

| Partition Deed Registration | 2% capped at Rs 25,000 | 7% on the amount of value of separated share |

| Settlement Registration | 2% capped at Rs 25,000 | 7 per cent 0.5% for family members |

| Registration of Release | Rs.100 | 7% |

| Receipt Registration | Rs.100 | Rs.1 |

| Registration of Exchange of Property | 2 percent of the consideration amount and on the market value of the greatest property | 5 percent of the consideration value of the property of greatest value |

| Registration of Deed of Adoption | Rs.100 | Rs.100 |

Calculate Stamp Duty And Registration Charges In Uttarakhand 2024

- First you have to visit the Official Website of this portal.

- The homepage will appear on your screen.

- Click on the E-Valuation link under the services tab.

- A new page will appear on your screen.

- Select your district and sub registrar office (SRO).

- A new page will appear on your screen.

- Select Article/Deed type, Sub Article/Sub Deed Type.

- Enter the category, Gender, Municipality, Land related information.

- The applicable stamp duty and registration charges will appear on your screen.

Search For a Registered Document In Uttarakhand 2024

- First you have to visit the Official Website of this portal.

- The homepage will appear on your screen.

- Click on the E-Search link.

- A new page will appear with various search options like:

- Village Name

- Party Name

- Property Number

- PDE Number

- Registration Number

- Registration Date

- Select one of the options and enter all the necessary details.

- You have to upload all the necessary discounts.

- The property’s registration documents will open after all the information has been entered.

FAQ’s

What are the stamp duty rates in Uttarakhand?

Stamp duty rates in Uttarakhand vary from 3.75 percent to 5 percent, depending upon the category and gender.

What duties fall within the authority of IGRS Uttarakhand?

IGRS Uttarakhand is officially in charge of stamping and registering property. Citizens can use IGRSUK services through the official website of the Department of Stamps and Registration.

What is the official website of this portal?

https://registration.uk.gov.in